Medicare: Why Make This Available To Your Bank Customers.

Enhanced Customer Loyalty and Retention

-

Added Value: Offering Medicare planning provides a valuable service, enhancing customer satisfaction.

-

Trust and Reliability: Helps build stronger relationships, fostering long-term loyalty.

-

Comprehensive Service: Position the bank as a one-stop shop for financial and health planning needs.

-

Generate New Customers: Medicare insurance is one of the most referred services from customers.

Twenty-five percent of new revenue is typically attributed to referrals from existing customers. A new

customer base the bank could market to for bank products and services.

Financial Security for Customers

- Informed Decisions: Educate customers on their Medicare options, helping them make better financial decisions.

- Cost Savings: Assist customers in choosing the right plans, potentially saving them money on healthcare costs.

- Risk Management: Help customers avoid unexpected medical expenses by planning ahead.

Competitive Advantage

- Market Differentiation: Stand out from competitors by offering unique and beneficial services.

- Customer Acquisition: Attract new customers looking for comprehensive financial services, including health planning.

- Increased Engagement: Regular touch-points through Medicare planning can lead to cross-selling opportunities.

Revenue Generation

- Service Fees: Generate additional revenue through consultation fees or commissions from Medicare plans.

- Increased Account Activity: Medicare planning can lead to more interactions and transactions with the bank.

-

Cross-selling opportunities: Leverage Medicare planning consultations to identify needs for other financial

products, such as savings accounts, loans, or retirement plans.

Addressing an Aging Population

- Demographic Shifts: Cater to the growing number of aging customers who need Medicare planning.

- Customer Needs: Address the specific needs of seniors, a significant segment of the bank's customer base.

- Community Support: Strengthen the bank's reputation as a supportive community partner for elderly customers.

Educational Outreach

- Workshops and Seminars: Host educational events to inform customers about Medicare, driving engagement and loyalty.

- Resource Provision: Offer brochures, online resources, and personal consultations to assist customers in navigating Medicare.

- Expert Guidance: Provide access to Medicare experts, ensuring customers receive accurate and beneficial advice.

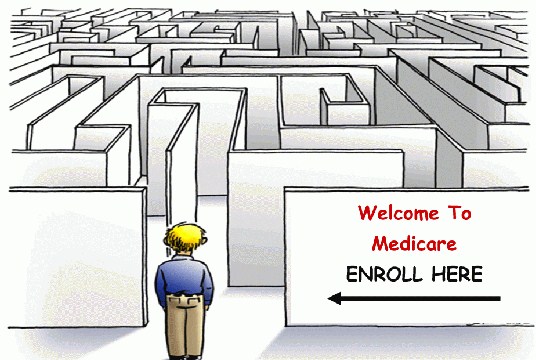

Mitigating Confusion and Complexity

- Simplify Decision-Making: Help customers navigate the complex Medicare system, reducing confusion and stress.

- Personalized Assistance: Offer tailored advice based on individual health needs and financial situations.

- Proactive Planning: Encourage early and proactive Medicare planning to avoid last-minute decisions.

By integrating Medicare planning into your services, you enhance value to your customers and open new avenues for growth and engagement,

solidifying your position as their trusted and primary financial institution.